9 Simple Techniques For Kam Financial & Realty, Inc.

9 Simple Techniques For Kam Financial & Realty, Inc.

Blog Article

The Definitive Guide to Kam Financial & Realty, Inc.

Table of ContentsKam Financial & Realty, Inc. Can Be Fun For EveryoneThe 6-Minute Rule for Kam Financial & Realty, Inc.How Kam Financial & Realty, Inc. can Save You Time, Stress, and Money.Kam Financial & Realty, Inc. - The FactsThe Single Strategy To Use For Kam Financial & Realty, Inc.Getting My Kam Financial & Realty, Inc. To Work

When one considers that home loan brokers are not needed to file SARs, the actual quantity of mortgage scams task might be much higher. (https://www.awwwards.com/kamfnnclr1ty/). Since very early March 2007, the Federal Bureau of Investigation (FBI) had 1,036 pending home mortgage fraudulence investigations,4 compared to 818 and 721, specifically, in the 2 previous yearsThe mass of home loan fraudulence drops into 2 broad groups based upon the inspiration behind the fraudulence. normally involves a consumer that will certainly overstate revenue or possession values on his/her financial statement to qualify for a lending to purchase a home (mortgage lenders in california). In a number of these cases, expectations are that if the earnings does not increase to satisfy the repayment, the home will certainly be cost a benefit from gratitude

Not known Factual Statements About Kam Financial & Realty, Inc.

The vast bulk of fraud circumstances are found and reported by the organizations themselves. According to a research study by BasePoint Analytics LLC, broker-facilitated fraud has actually appeared as the most widespread segment of home mortgage fraudulence nationwide.7 Broker-facilitated home loan scams happens when a broker materially misstates, misstates, or omits info that a finance officer relies on to decide to expand credit.8 Broker-facilitated scams can be fraudulence for home, fraudulence for earnings, or a mix of both.

A $165 million neighborhood bank determined to enter the home loan financial organization. The bank bought a small home mortgage company and employed a knowledgeable mortgage lender to run the procedure.

Fascination About Kam Financial & Realty, Inc.

The bank notified its main government regulator, which after that called the FDIC due to the fact that of the potential influence on the financial institution's monetary problem ((https://www.avitop.com/cs/members/kamfnnclr1ty.aspx). Additional investigation exposed that the broker was working in collusion with a home builder and an appraiser to turn homes over and over once more for higher, bogus profits. In overall, more than 100 lendings were stemmed to one building contractor in the very same subdivision

The broker refused to make the payments, and the case entered into lawsuits. The bank was ultimately granted $3.5 million. In a subsequent discussion with FDIC supervisors, the bank's head of state showed that he had actually constantly heard that the most tough part of home loan financial was making certain you implemented the best hedge to balance out any rates of interest run the risk of the financial institution could incur while warehousing a significant volume of home loan finances.

The Facts About Kam Financial & Realty, Inc. Uncovered

The financial institution had representation and guarantee conditions in contracts with its brokers and assumed it had recourse with respect to the lendings being stemmed and offered via the pipe. During the litigation, the third-party broker argued that the bank ought to share some responsibility for this direct exposure due to the fact that its inner control systems must have recognized a funding focus to this class and set up steps to prevent this danger.

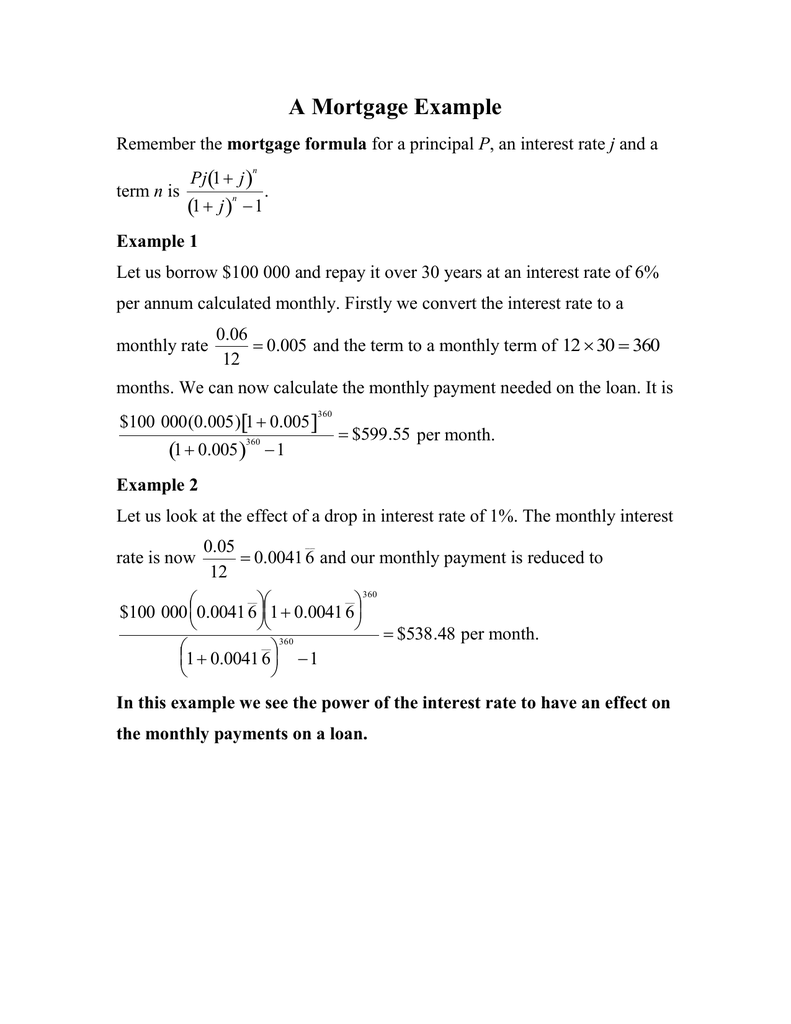

What we call a regular monthly mortgage settlement isn't just paying off your home loan. Rather, believe of a month-to-month home mortgage settlement as the four horsemen: Principal, Rate Of Interest, Residential Or Commercial Property Tax Obligation, and Property owner's Insurance (called PITIlike pity, because, you know, it increases your repayment).

However hang onif you believe principal is the only total up to think about, you 'd be forgeting principal's buddy: passion. It 'd be great to believe lenders let you borrow their money just due to the fact that they like you. While that could be true, they're still running a business and wish to place food on the table also.

The Buzz on Kam Financial & Realty, Inc.

Rate of interest is a percent of the principalthe quantity of the lending you have entrusted to pay back. Passion is a percent of the principalthe quantity of the financing you have actually entrusted to pay off. Home mortgage rates of interest are constantly altering, which is why it's wise to select a home mortgage with a fixed rates of interest so you recognize just how much you'll pay every month.

That would indicate you you can check here would certainly pay a tremendous $533 on your initial month's home loan settlement. Prepare yourself for a little bit of mathematics below. But don't worryit's not complicated! Utilizing our mortgage calculator with the example of a 15-year fixed-rate home mortgage of $160,000 once again, the complete interest expense mores than $53,000.

Fascination About Kam Financial & Realty, Inc.

That would certainly make your monthly home loan settlement $1,184 every month. Regular monthly Principal $1,184 $533 $651 The next month, you'll pay the exact same $1,184, yet less will certainly most likely to rate of interest ($531) and extra will certainly most likely to your principal ($653). That fad proceeds over the life of your home mortgage till, by the end of your home loan, virtually all of your repayment approaches principal.

Report this page